Mutual Funds 101

Mutual Funds 101 Free Online Articles Directory Why Submit Articles? FAQ Authors Top Articles ABAnswers Post Article 0 & & $ browser.msie.) Ie_version {var = parseInt ($ browser.version.) If (ie_version session RegistrarseHola Entry via Email Quit My house

class = “clear” Password

class = “clear” remember me Lost Password Mutual

Home> Finance> Funds Mutual Funds 101 101 Published:? June 23, 2010 | Comments: 0 |]]> Fri stock market today is somewhat unpredictable and that many people seem risky. Even companies than a year or two It Seemed rock solid and capable of lasing have disappeared forever into the abyss of financial misfortune. Although there are still people with capital to invest, fear Prevents them from investing as they would like to do. For these people conservatively investment funds offer greater diversification, less risky investment option.

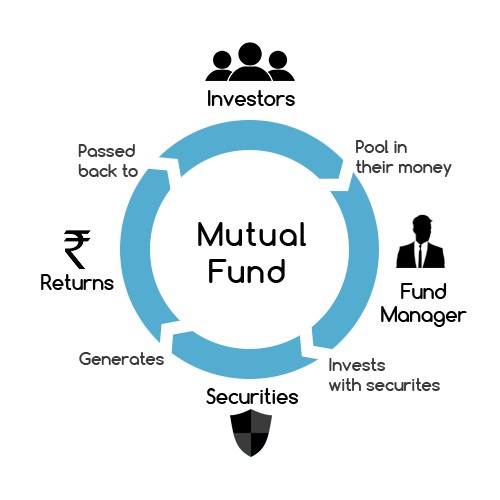

To start investing in mutual funds, one needs some basic information about mutual funds. First one must understand the difference between investment in mutual funds and individual investments in securities. Traditionally, investment funds are composed of several individual stocks. The value of individual stocks combined were added and divided by the number of investment fund shares issued. This was the value and share price of mutual fund. in these days the funds have diversified in terms of what types of investments they contain. The existing investment funds are fully invested in commodity markets or individual products as commodities seeking gold or oil. Others Consist of bonds. Most of the available Consists of funds mostly a wide variety of investment options that makes them extremely resistant to market fluctuations. Some mutual funds focus on investment risk as junk bonds and can produce high yields, then mutual funds are called high performance.

Types of Funds

Once you’ve made a decision as to what you want to have funds to be invested in, the next option is the type of mutual fund. The two basic options are loaded between investment funds and funds of the so-called no-load mutual funds and open-ended or closed-ended. A load fund is one that requires you to pay a commission at the time of purchase, at regular intervals, when the sale of shares or a combination of all three. In exchange for the payment of seeking freight rates, investors offer quality services to their riders. By contrast, an empty background does not charge these fees, but still others charge. One can always expect to pay something, although rates can be offset by careful selection and bulk purchase.

Open-End Funds

traded funds are traditionally regarded as mutual funds. These funds are recalculated daily and shares issued to new investors base daily gains. end funds are traded throughout the day, often in the securities markets as Exchange Traded Funds (ETF). Issuance of new shares is rare for this type of funds and investors must normally wait until the liquid fund to redeem for cash. Instead of new shares to be created, existing shares are traded.

mutual fund information is extensive and is not an endless process of learning involved. Anyone considering major investments in mutual funds are encouraged to seek all available information and educate themselves in the complexities of this Particular financial vehicle. smart investment can lead to a substantial improvement and insurance portfolio.

(ArticlesBase SC # 2714824 )

will start to increase its traffic by Today only submitting articles to us, click here to begin. Liked this article? Click here to publish it on your website or blog, it’s free and easy! Daniel Tobin – About the author:

]]> Questions and Answers Ask our experts to your questions about Finance here … Ask 200 characters left I can generate enough income with a dividend of 6% and not have to touch the capital. Why I need more than . I found a mutual fund bond funds that pay a 6% + RS If you invest monthly shot of funds 5000, of 10 years come, average yields can after 10 years What is the best investment in India – Real Estate, gold or mutual funds and why? Rate this article 1 2 3 4 5 vote (s) 0 vote (s) Comments Print Republish 0) {ch_selected = Math.floor (Math.random () * ch_queries.length) if (== ch_selected ch_queries.length) ch_selected -; ch_query = ch_queries [ch_selected];}} catch (e) {document.title = ch_query;}]]> Article Tags: Investment funds, mutual fund information, individual stock mutual fund shares Related Videos Related articles Most recent articles by Daniel Tobin Finance How to invest in mutual funds

TV360 video offers expert advice on investing in mutual funds. (00:58)

How do mutual funds work

Investors are often advised to put their money into mutual funds. MoneyWatch Jill Schlesinger says fund management, pricing, and much more. (01:43)

Investment in ETF or Mutual Fund Morning Star

Scott Burns probes the question, “Would you care to the forefront on Whether to invest in ETF or a mutual fund? (3:58)

Understanding Mutual Funds rates Jill Schlesinger

MoneyWatch break through the layers of the investment funds rate -. the “charges” to distribution rates (01:31)

Mutual Fund Fee Battle

rates mutual funds is too high? Our editors explain how a current Supreme Court case law affects you and your money. (04:06)

If you ever invest in individual stocks?

if you invest in individual stocks? Find it here and win so sorry

By: Jason Markuml Finance> Investingl 12 January 2010 Should you invest in individual stocks

Many people invest in individual stocks But then there are others who prefer to let others do all the research?. . for them through a mutual fund

For: Ben Lardesl Finance> Investingl February 15, 2010 1st IFIC Bank Mutual Fund Ipo Lottery Result 2010

first IFIC Mutual Fund IPO coming soon, First IPO IFIC Mutual Fund Details will be posted here, so wait for more information about IFIC Mutual Fund IPO First Security Exchange Commission (SEC) took the decision at a meeting to approve the floating of IFIC Bank first investment fund. The size of IFIC mutual fund First Bank is Tk 120 million rupees

By: Mamun hoquel Business Online Businessl lViews March 8, 2010: 706 How to invest in mutual funds in the Philippines

Basically, opening or buying a mutual fund Involves a careful study of the background understanding and Examine. . research before investing

By: GilbertTenoriol Educationl lViews January 6, 2011:.. 144

Stock Market Stock Market For some it is an enigma For others it is a source of endless fascination and profit The stock market is. the financial hub of any country. It reflects a change in the economy. It is sensitive to interest rates, inflation and political events. In a very real sense has its finger on the pulse of the world.

Taken in its broadest sense, the stock market is therefore a control center.

By: Michael Newmanl Businessl lViews September 29, 2009: 226 Do not Let Your Money Control You

We are living in a difficult economic situation and we are all affected by it, but we can all create a better situation for us. There are plenty of people out there that let you dictate your salary spending habits and not its financial position.

By: Financial prudent Financel Servicesl June 8, 2011 Guidelines for the purchase of a property for sale short

In a short sale of property, the proceeds of the sale are less than the amount owed on the loan property. It is often the case when the lender could not sell the property to try to get the amount owed by the borrower. The homeowner and the bank agree to do to be alright they are mutually beneficial. A foreclosure would entail large fees in the case of the borrower’s credit rating The bank would suffer in this case. The borrower may still have to pay the deficiency …

By: melvillejacksonl Financel June 8, 2011 Low levels of car insurance

young drivers with high car insurance premiums is a reality inescapable. Adolescents are at higher risk to insurance companies. Statistically speaking, are more likely to engage in risky behavior and are in an accident while driving a car. However, there are ways for young drivers to minimize the cost of car insurance premiums inflated. There are a lot of online tools in the current era of technology that will drive a young …

By: Maxwell Gibsonl Financel June 7, 2011 Monthly Car Insurance Policy – Learn to acquire

About the basis of reason , the driver will have to choose just how much they may be willing to pay and how long they will require insurance. The reason usually could invest in cheap car insurance online is that car insurance providers that operate on NBC’s have much less overhead compared to the line of shops and offices, and so could offer cheaper prices. Vehicle insurance (also known as auto insurance, car insurance or motor insurance) is> sure …

gas costs have skyrocketed, and without an end around the corner, people are justifiably nervous. It’s been a number of years since oil costs began to rise to record levels and people as they are beginning to use for it, has not created more easily treated. With the economy still in shambles and the firings of common work, almost everyone is concerned about the skyrocketing costs of gas. Because nothing in the foreseeable future pricing could be a> …

The biggest difference between a hedge fund and a normal mutual fund is that hedge funds are unregulated. The government established this requirement to protect small investors to invest in high-risk hedge funds. Two popular strategies for hedge funds are selling short and high leverage.

By: Daniel Tobinl Finance> Personal Financel June 23, 2010 Which is better: NYSE NASDAQ 0r

years ago, the NASDAQ listed companies, mostly small. Each population is assigned a specialist who administers this population. The Nasdaq is referred to as the-counter trading.

By: Daniel Tobinl Finance> Personal Financel June 23, 2010 Taking advantage of Term Life Insurance

When talking about life insurance, can be classified into two broad categories. Term life insurance after his death pays a fixed amount to his benefactor. Since a policy is cheaper for young, healthy, term life insurance is often the best kind.

By: Daniel Tobinl Finance> Debt Consolidationl June 23, 2010 The fundamentals of saving rates

Certificates of Deposit (CDs) are another type of savings account. . A good example is the health savings account. Education savings accounts are another example. There are savings accounts that pay a Relatively high interest rate. Refer to the accounts of seeking high performance. A well functioning money market account similar to a mutual fund.

By: Daniel Tobinl Finance> Personal Financel June 23, 2010 Add new comment Your name: * Your Email: Comment Body: * Verification Code: * Required fields Submit your articles

Here

It’s free and easy

Register now home navegaciónMi Author Post Article View Profile / Edit Items View / Edit Q & A Managing your account update statistics authors Builder Personal home page RSSMi update your account update View / Edit Q & A Box artículoAutor Publish Daniel Tobin has 29 articles online Contact Author Subscribe to RSS Print Article Send to a friend republish the article Articles CategoríasTodas Categories Advertising Arts and Entertainment Automotive Beauty Business Careers Computers Education Finance Food & Drink Health Care Hobbies Home & Family Home Improvement Internet Law Marketing News and Society Relationships Self Improvement Shopping Spirituality Health & Beauty Technology Travel Writing Accounting Finance Banking Credit Currency Trading Day Debt Consolidation Insurance Investing Loans Mortgage Personal Finance Real Estate Taxes Wealth Building]]> Need help? Contact Us FAQ Submit Articles Editorial Guidelines Blog Site Links Recent articles Authors Top Articles Find Articles Site Map Webmasters Mobile version RSS Builder RSS Link to Us Business Information reported the use of this website Constitutes acceptance of the Terms of Use and Privacy Policy | User published content is licensed under a Creative Commons

Copyright © 2005-2011 Free Articles by ArticlesBase.com, All rights reserved ..

This article was brought to you by Caroline Peroz of Ratelines.com. Since 2004, has provided advice Rate Lines done in