Many people aim for achieving financial freedom. Enough Investments, savings and cash in hand to offer a suitable lifestyle for yourself and your family. Also will let you exit or hunt the career of your choice to earn a certain amount every year.

Sadly, only a few achieve it. As many people are loaded under increasing debt, profligate spending, financial emergencies and so on that frustrate those people and lead to no achievements. Besides, there are unpredictable affairs like a hurricane or any pandemic that leads to cancellation and reveals the safety procedures that weren’t clear in advance.

Mostly everyone faces difficulty but these habits that are mentioned below can show you the right way:

Individual’s Objective

According to your dictionary, what do you understand about financial freedom? Be particular as a wide wish for it is also unclear an objective. The more an individual will be particular about his/her objective, the more chances of achieving them. An individual must write all the details about their necessary bank balance, what to achieve in life and till what age their aim must be achieved.

Secondly, calculate your age and focus on creating a financial climax from time to time. Use the written notes about your aim neatly and place and prioritise them on your financial binder.

Designate a budget

The finest way to assure that all the savings and expenses are on point is to design a household budget and manage to stick to that. It is a good way to manage your expenditure and to reinforce your aim without spending excessively.

Honour credit cards in full

It is complicated to build wealth by high-interest consumer loans and Credit cards. So better is to set an accurate amount to pay off the full balance timely. Also, mortgages, student loans and alike loans with lower interest rates are preferable. It also builds the best credit rating after paying periodically.

Make automated savings

To build whole use of any similar contribution benefit, apply in your employer’s retirement plans. An automatic withdrawal in any emergency requirement of funds that can be exploited for unpredictable expenses is a clever decision. Also automatic contribution to a financier account or something close to it.

Preferably, the amount must draw the similar day one received his/her paycheck so that it avoids temptation entirely. But, always remember that the suggested amount to save is highly debated. In some cases, the workability of funds can be a problem.

Begin investing

A most common question that arises because of the bad stock market, however, there’s no great way to build your money by investing till now. Compound interest’s magic aids big growth

yet it takes a long time to get some growth. Also, there is no need to be a stock picker or to scheme yourself in assuming that you can be the upcoming Warren Buffett. There is one and only.

In addition, to learn the techniques to invest, build a manageable portfolio, and build monthly or weekly offers to it automatically one can open an online brokerage account for ease. You can also start the best online brokers for beginners.

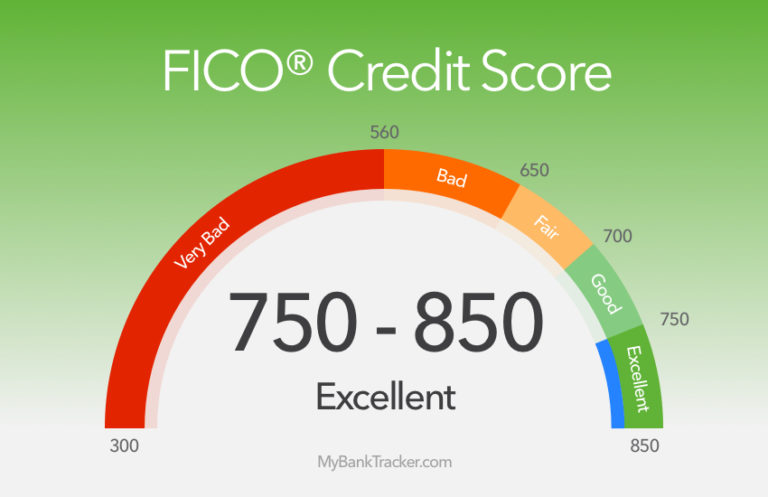

Focus on your credit

When you need to buy a new car or refinance a home, your credit score will decide the amount of interest provided. This also crashes separate things like life and car insurance premiums.

A person with careless financial habits is used to being careless on all sides, for example drinking and driving. For this reason, it becomes essential to collect credit reports periodically just to ensure that no incorrect marks are spoiling your name. To get more information about this thing, the best credit monitoring services are a good option to look at.

Negotiate

Many Americans don’t negotiate on any goods or services because of hesitation that this thing will represent them cheaply. This culture and thinking have to be changed so that it can lead to savings. Doors of discounts need to be opened where one is ordering in bulk besides, small businesses are prone to negotiation.

Educational continuity

To recognise all the accommodations and withdrawals are accelerated one review all the relevant substitutes in the tax laws every year. Make a habit to take all the financial news and growth in the stock market and adjust your investment portfolio correspondingly. For all those who prey on unworldly backers to turn a quick buck, knowledge is the finest shielding.

Maintenance

Maintenance makes everything last long and the same as new whether it’s a car or clothes. It is an investment that one must on miss as the cost of maintenance is a fraction of the cost of the replacement.

Live Below Means

Excelling is a thrifty way of living that is not so rigid by adopting the perspective of living life to the fullest. Actually, a number of rich persons grow regularly by economising their resources.

It is not a difficult task to have a habit of simplicity or not a MS managed situation for which you have to do something in order to achieve your goal. It is just an actor to make arrangements for your needs and wants.

Financial advisor

When you come to know where your reasonable amount of money has been accumulated- liquid investments or fixed assets which are not in liquid form- then it is the correct time to have an advisor that will teach you and aid you in getting proper selections in future.

Health first

It is also essential to maintain your health. Go for periodic body checkups and book your appointments with dentists timely which is primary. Even many of your health issues can be prevented by changing your lifestyle and adding a healthy diet as well as regular exercise in your schedule. Many companies face less or no loss because they promote health maintenance too. A healthy environment will promote more positivity and power that will result in profit and growth.

Conclusion

The above steps are not enough to solve all your financial problems. However, these suggestions will help you make healthy and positive habits for the path of financial freedom.