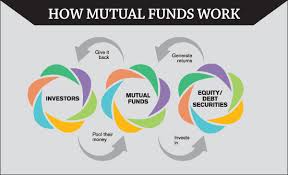

The basic definition of mutual funds is that they are managed portfolios of stocks and/or bonds. Another way we could approach defining a mutual fund may be to say that mutual funds are companies with lots of clients or shareholders whose money is accumulated and invested into shares and/or stocks with the aim of making a profit for the shareholders. The fact that the fund is owned by a lot of small shareholders is the reason they are called ‘mutual’ funds.

Mutual Funds vs. Individual Stocks

There is a fundamental difference between investing your money into a company’s stock, or buying bonds, and investing in a mutual fund. Firstly, buying stock in a mutual fund does not give you any voting rights, which you could use to influence the fund’s business decisions. Furthermore, stock in a mutual fund practically represents partial ownership of a wide array of different companies and their stocks.

The way in which an investor can profit from a mutual fund is also a bit different from owning regular stock. There are three main ways in which an investor can make money off a mutual fund. Firstly, the fund may invest in various companies on the shareholders’ behalf, and once profits are extracted from these investments, they get distributed to the shareholders according to their ownership of the fund’s stock.

The shareholders are usually allowed to decide whether they want to re-invest these profits by buying more of the fund’s stock, and thus gaining more of the profits in the future, or whether they merely want to pocket the money and keep their ownership percentage the same.

Secondly, the fund may also sell off some of its securities, if these have increased in price to an extent considered profitable by the fund managers, thus accruing a capital gain. Most of these gains are also distributed to shareholders in the same way as the above case.

Finally, if the holdings of the fund increase in value, the fund’s stock price will also increase. This is an opportunity for an investor to sell off some or all of their stock in the fund in order to make a profit. This works exactly the same as it would with any other company.

Naturally, as with any sort of investment, investing in a mutual fund has its benefits and drawbacks. Let us take a look at some of them so that a clearer picture of the essence of mutual funds can be formed. Let us examine at some of the advantages of mutual funds.

Advantages of Mutual Funds

Firstly, the main advantage of mutual funds is arguably the fact that they are managed by professionals. This is important due to the fact that people with proper training and experience know how to pick which stocks and/or bonds to include in a portfolio in order to maximize the profits in a way that is safe for the investors. On top of that, a mutual fund may have more information on which to base these decisions, as opposed to a single small investor.

Another advantage of mutual funds is the fact that diversification is baked into the business model. Diversification is a very important aspect of any portfolio, since it allows you to minimize the risks associated with any particular investment, since you own a small amount of stock in many different firms, so if one of those firms goes bust, you end up losing relatively little money.

The fact that any given mutual fund has so many shareholders and owns such an array of stocks allows for the exploitation of economies of scale. Firstly, since mutual funds buy and sell large amounts of securities quite often, that means that the transaction costs are lower than those an individual would likely be required to pay to accomplish the same thing. Furthermore, when the money of many small shareholders is pooled together, it can allow the management to make much more aggressive and profitable investments than an individual would be able to.

Disadvantages of Mutual Funds

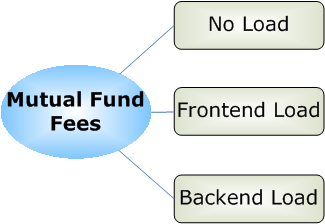

However, there are also disadvantages to holding stock in a mutual fund. Firstly, managed funds have not proven particularly effective in achieving higher rates of return for their investors than passive index funds, which track the stock market, in the last few years. Furthermore, the fees and costs of owning stock in a mutual fund are also considerable, and they can eat into an investor’s profits.

When we combine these two disadvantages, we arrive at the question of why we should invest in a fund which may not even beat the market, while managers get paid whether they win or lose? The answer to this question comes down to choosing the right fund to invest your money in.