As discussed previously, it is very important that you choose the right mutual fund, for several reasons. Firstly, you need to take into account its business model, as well as the fees and costs involved with holding stock in such a fund. Secondly, and probably more importantly, you need to define what your financial goals are, i.e., why you are investing in the first place.

You may want to put all your profits into your current account, in order to spend it on everyday expenses. This would be considered a s short-term investment. However, many people use mutual funds as a means of securing their long-term financial future, such as planning for retirement, or making a college fund for their child.

Depending on the reason for investing there are several different types of fund to choose from. If you needed cash for short-term spending, you would do well to invest in a money market fund. For spending in a few years’ time, bond funds are the best choice, and finally, for long-term investments, stocks funds are the best bet.

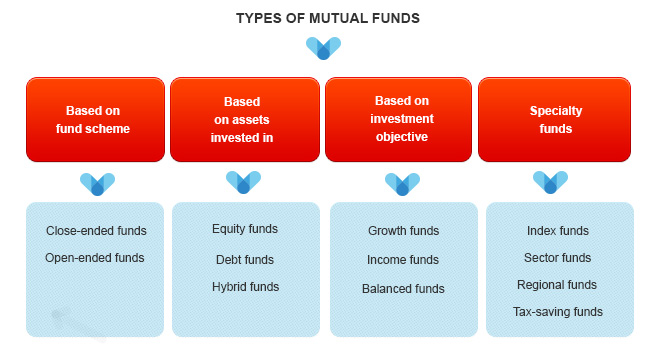

Types of Mutual Funds

Another important consideration when considering the type of fund you want to invest in is your risk tolerance. If you think you would be able to afford and cope with dramatic swings in portfolio value, for example, you may want to invest in stock funds instead of bond funds. If you are more conservative in your risk tolerance, the better choice would be investing in a bond fund. The most conservative choice is the money mutual fund, which is also considered to be something of an alternative to simply holding cash.

The other main aspect to choosing a mutual fund is actually finding one that suits you. Finding mutual funds has been simplified considerably by the advent of the internet. A simple Google search using the search term ‘mutual fund’ will yield millions of hits, and the most reputable funds will likely emerge among the top results.

There are also other online services and resources which may be able to help you with your choice. You can use sites such as Morningstar and Kiplinger to research mutual funds, since they carry a lot of information that is up-to-date and reliable. Also available is the Mutual Fund Education Alliance (MFEA), which is a non-profit trade association which provides search tools that allow you to find no-load funds.

Niche sites can also be useful, if you can find one that aligns well with your needs and investing philosophy. LipperLeaders, for example, is a company owned by Thomson Reuters, which evaluates funds on the basis of five metrics considered most important to the functioning of mutual funds. They call these metrics ‘Leaders’. They include the total historical return, consistency of returns, preservation of capital, expenses, and tax efficiency.

Buying Mutual Funds

Once you have found a fund that aligns with your interests, the next question is how the procedure for actually buying into it works? There are many ways you can come into possession of mutual fund stock. You could buy stock through a broker, a bank, an insurance agent, or a financial planner. These usually extract a fee in order to to this on your behalf, but if you want to avoid these, there are funds which also sell stock directly, and charge no fees to do it (other than the stock price, naturally).

There are also low-fee programs which offer stock in many different mutual funds in one place. These are often referred to as ‘fund supermarkets’, and they even offer record keeping services that keep track of all the purchases you made through them, even if you buy into different fund families. Some examples of ‘fund supermarkets’ include Schwab’s OneSource, Vanguard’s FundAccess, and many others.

Once you have found a mutual fund you are interested in investing in, you should keep note of the share price. The share price for a mutual fund is calculated based on its net asset value (NAV), which is the fund’s assets minus its liabilities. NAV per share is the value of one share in the mutual fund, and this is the first number available to the potential investor when researching mutual funds. As any share price, the NAV per share fluctuates in value daily, as the holdings and liabilities of the company change.