The definition of a mutual fund A mutual fund is a different type of a company where the money comes from various investors. In addition to that, they try to invest in securities that do not represent an incredible risk to the participants. The most important part of a mutual fund is its portfolio. In… Continue reading What Are Mutual Funds and How Do They Work?

Month: January 2018

Evaluating the Performance of Your Mutual Funds

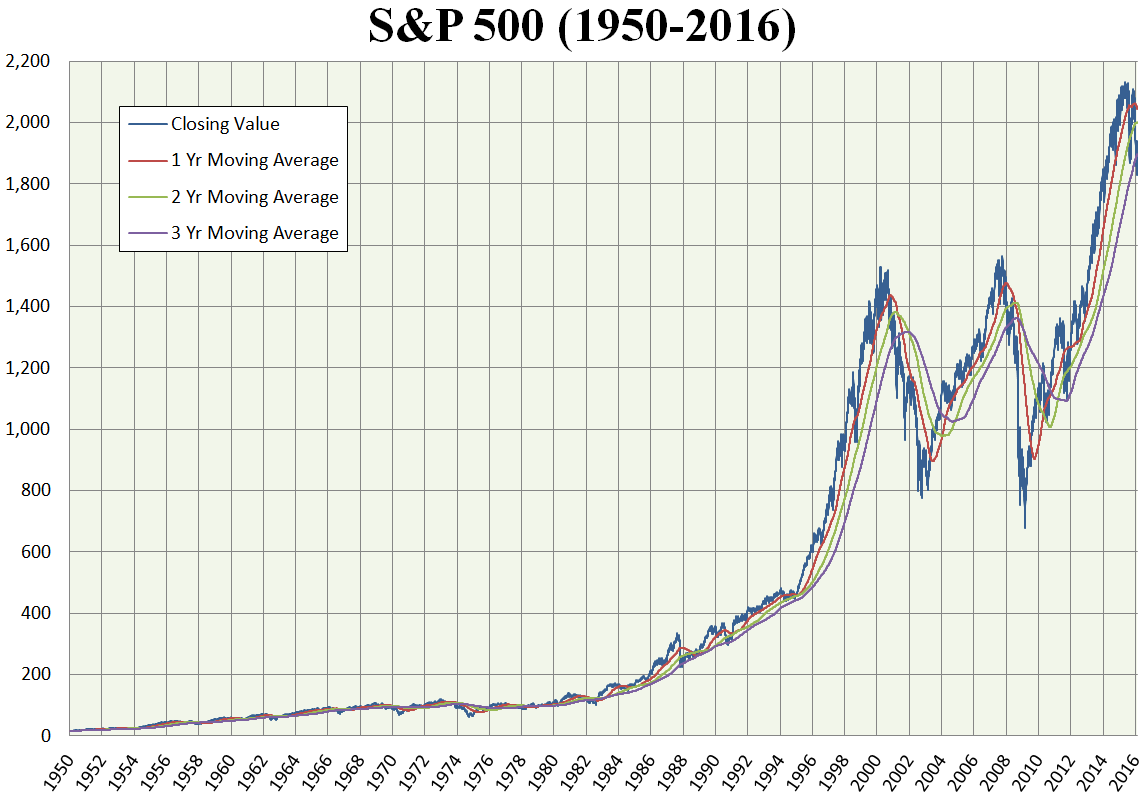

When choosing which mutual fund to invest your money in, you may go off the one-year return rates, and arrive at the conclusion that a particular fund was very successful. However, it is not enough to merely look at the return rates for one year. Instead, you should take a look at a couple of… Continue reading Evaluating the Performance of Your Mutual Funds